|

STUDENT DIGITAL NEWSLETTER ALAGAPPA INSTITUTIONS |

|

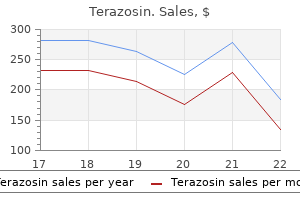

Ehab Hanna, MD, FACS

Nor does the Noerrdoctrine apply to horizontal boycotts even if the object is to force the government to take action blood pressure medication zanidip order 5 mg terazosin amex. Although some inroads have been made in the way that the leagues and clubs may exercise their power hypertension treatment in pregnancy terazosin 2 mg fast delivery, the basic decision stands blood pressure higher at night 5 mg terazosin with visa. In addition hypertension risks purchase terazosin 2 mg without a prescription, First Amendment concerns allow trade groups to solicit both state and federal governments pulse pressure under 25 buy terazosin 5mg low price, and state law may sometimes provide a "state action" exemption heart attack sum 41 discount terazosin 2 mg with visa. Find out why Curt Flood brought an antitrust lawsuit against Major League Baseball and what the Supreme Court did with his case. Recognize the importance of defining the relevant market in terms of both geography and product. Introduction Large companies, or any company that occupies a large portion of any market segment, can thwart competition through the exercise of monopoly power. As the Supreme Court has long defined it, monopoly is "the power to control market prices or exclude competition. A far smaller company that dominates a relatively small geographic area or that merges with another company in an area where few others compete can be in for trouble under Sections 2 or 7. These laws should therefore be of concern to all businesses, not just those on the Fortune 500 list. In this section, we will consider how the courts have interpreted both the Section 2 prohibition against monopolizing and the Section 7 prohibition against mergers and acquisitions that tend to lessen competition or to create monopolies. Section 2 of the Sherman Act reads as follows: "Every person who shall monopolize, or attempt to monopolize, or combine or conspire with any other person or persons, to monopolize any part of the trade or commerce among the several states, or with foreign nations, shall be deemed guilty of a [felony]. Section 2 itself makes this proposition inescapable: it forbids the act ofmonopolizing, not the condition or attribute of monopoly. The answer is that we cannot hope to have "perfect competition" but only "workable competition. Demand for a product might be limited to what one company could produce, there thus being no incentive for any competitor to come into the market. A small town may be able to support only one supermarket, newspaper, or computer outlet. If a company is operating efficiently through economies of scale, we would not want to split it apart and watch the resulting companies fail. An innovator may have a field all to himself, yet we would not want to penalize the inventor for his very act of invention. Or a company might simply be smarter and more efficient, finally coming to stand alone through the very operation of competitive pressures. It would be an irony indeed if the law were to condemn a company that was forged in the fires of competition itself. As the Supreme Court has said, the Sherman Act was designed to protect competition, not competitors. The law penalizes not the monopolist as such but the competitor who gains his monopoly power through illegitimate means with an intent to become a monopolist, or who after having become a monopolist acts illegitimately to maintain his power. The question of relevant market has two aspects: a geographic market dimension and arelevant product market dimension. It makes a considerable difference whether the company is thought to be a competitor in ten states or only one. A large company in one state may appear tiny matched against competitors operating in many states. Likewise, if the product itself has real substitutes, it makes little sense to brand its maker a monopolist. For instance, Coca-Cola is made by only one company, but that does not make the Coca-Cola Company a monopoly, for its soft drink competes with many in the marketplace. This makes it difficult to examine each separately, but to the extent possible, we will address each factor in the order given. Relevant Markets: Product Market and Geographic Market Product Market the monopolist never exercises power in the abstract. When exercised, monopoly power is used to set prices or exclude competition in the market for a particular product or products. Therefore it is essential in any Section 2 case to determine what products to include in the relevant market. The Supreme Court looks at "cross-elasticity of demand" to determine the relevant market. That is, to what degree can a substitute be found for the product in question if the producer sets the price too high If consumers shift to another product with slight rises in price, then the product market is "elastic" and must include all such substitutes. Because of this, alleged monopolists will usually argue for a broad geographic market, while the government tries to narrow it by pointing to such factors as transportation costs and the degree to which consumers will shop outside the defined area. Monopoly Power After the relevant product and geographic markets are defined, the next question is whether the defendant has sufficient power within them to constitute a monopoly. The usual test is the market share the alleged monopolist enjoys, although no rigid rule or mathematical formula is possible. Monopolization: Acquiring and Maintaining a Monopoly Possessing a monopoly is not per se unlawful. Once a company has been found to have monopoly power in a relevant market, the final question is whether it either acquired its monopoly power in an unlawful way or has acted unlawfully to maintain it. This additional element of "deliberateness" does not mean that the government must prove that the defendant intended monopolization, in the sense that what it desired was the complete exclusion of all competitors. It is enough to show that the monopoly would probably result from its actions, for as Judge Hand put it, "No monopolist monopolizes unconscious of what he is doing. Lorain Journal Company, the town of Lorain, Ohio, could support only one newspaper. But when a radio station was set up, the paper found itself competing directly for local and national advertising. To retaliate, the Journal refused to accept advertisements unless the advertiser agreed not to advertise on the local station. The Court agreed that this was an unlawful attempt to boycott and hence was a violation of Section 2 because the paper was using its monopoly power to exclude a competitor. The Court said that the radio station was in interstate commerce because it broadcast national news supported by national advertising. In the Aluminum Company case, Alcoa claimed its monopoly power was the result of superior business skills and techniques. These superior skills led it to constantly build plant capacity and expand output at every opportunity. But Judge Hand thought otherwise, given that for a quarter of a century other producers could not break into the market because Alcoa acted at every turn to make it impossible for them to compete, even as Alcoa increased its output by some 800 percent. When the underlying products are changed-mainframe computers, new types of cameras-the existing manufacturers are left with unusable inventory and face a considerable time lag in designing new peripheral equipment. Had these cases been sustained on appeal, a radical new doctrine would have been imported into the antitrust laws-that innovation for the sake of competing is unlawful. The Supreme Court has not heard cases in this area, so the law that has emerged is from decisions of the federal courts of appeals. Memorex sought to use the antitrust laws to make time stand still and preserve its very profitable position. This court will not assist it and the others who would follow after in this endeavor. Attempts to Monopolize Section 2 prohibits not only actual monopolization but also attempts to monopolize. An attempt need not succeed to be unlawful; a defendant who tries to exercise sway over a relevant market can take no legal comfort from failure. In any event, the plaintiff must show a specific intent to monopolize, not merely an intent to commit the act or acts that constitute the attempt. Leasing and pricing practices that are perfectly lawful for an ordinary competitor may be unlawful only because of Section 2. But the more important reason is the remedy provided by the Sherman Act: divestiture. In the Standard Oil decision of 1911, the Supreme Court held that the Standard Oil Company constituted a monopoly and ordered it split apart into separate companies. In many of the early cases, doing so posed no insuperable difficulties, because the companies themselves essentially consisted of separate manufacturing plants knit together by financial controls. But not every company is a loose confederation of potentially separate operating companies. Because any aluminum producer needs considerable resources to succeed and because aluminum production is crucial to national security, the later court refused to order the company broken apart. The court ordered Alcoa to take a series of measures that would boost competition in the industry. Although the trend has been away from breaking up the monopolist, it is still employed as a potent remedy. Under Section 2 of the Sherman Act, it is illegal to monopolize or attempt to monopolize the market. If the company acquires a monopoly in the wrong way, using wrongful tactics, it is illegal under Section 2. Courts will look at three questions to see if a company has illegally monopolized a market: (1) What is the relevant market Mammoth Company, through three subsidiaries, controls 87 percent of the equipment to operate central station hazard-detecting devices; these devices are used to prevent burglary and detect fires and to provide electronic notification to police and fire departments at a central location. In an antitrust lawsuit, Mammoth Company claims that there are other means of protecting against burglary and it therefore does not have monopoly power. Explain how the Justice Department may be able to prove its claim that Mammoth Company is operating an illegal monopoly. Describe how the courts will define the relevant market in gauging the potential anticompetitive effects of mergers and acquisitions. As originally written, neither did the Clayton Act, which prohibited only mergers accomplished through the sale of stock, not mergers or acquisitions carried out through acquisition of assets. In 1950, Congress amended the Clayton Act to cover the loophole concerning acquisition of assets. No corporation shall acquire, directly or indirectly, the whole or any part of the stock or other share capital and no corporation subject to the jurisdiction of the Federal Trade Commission shall acquire the whole or any part of the assets of one or more corporations engaged in commerce, where in any line of commerce in any section of the country, the effect of such acquisition, of such stock or assets, or of the use of such stock by the voting or granting of proxies or otherwise, may be substantially to lessen competition, or to tend to create a monopoly. For example, a book publisher that buys a paper manufacturer has engaged in backward vertical integration. Conglomerate Mergers Conglomerate mergers do not have a standard definition but generally are taken to be mergers between companies whose businesses are not directly related. In a "pure" conglomerate merger, the businesses are not related, as when a steel manufacturer acquires a movie distributor. In a product-extension merger, the manufacturer of one product acquires the manufacturer of a related product-for instance, a producer of household cleansers, but not of liquid bleach, acquires a producer of liquid bleach. In a market-extension merger, a company in one geographic market acquires a company in the same business in a different location. Therelevant geographic market is any section of the country, which means that the plaintiff can show the appropriate effect in a city or a particular region and not worry about having to show the effect in a national market. The Court specifically held that even though the stock acquisition had occurred some thirty-five years earlier, the government can resort to Section 7 whenever it appears that the result of the acquisition will violate the competitive tests set forth in the section. The Failing Company Doctrine One defense to a Section 7 case is that one of the merging companies is a failing company. United States, the Supreme Court said that the defense is applicable if two conditions are satisfied. The court also said that "if concentration is already great, the importance of preventing even slight increases in concentration and so preserving the possibility of eventual de-concentration is correspondingly great. When one of the companies has sales or assets of $100 million or more and the other company $10 million or more, premerger notification must be provided at least thirty days prior to completion of the deal-or fifteen days in the case of a tender offer of cash for publicly traded shares if the resulting merger would give the acquiring company $50 million worth or 15 percent of assets or voting securities in the acquired company. Of course, had Ford entered the market on its own by independently manufacturing spark plugs, it might ultimately have caused weak competitors to fold. In the late 1960s and early 1970s, the government filed a number of divestiture suits against conglomerate mergers. Thus International Telephone & Telegraph Company agreed to divest itself of Canteen Corporation and either of the following two groups: (1) Avis, Levin & Sons, and Hamilton Life Insurance Company; or (2) Hartford Fire Insurance Company. Ling-Temco-Vought agreed to divest itself of either Jones & Laughlin Steel or Braniff Airways and Okonite Corporation. In these and other cases, the courts have looked to specific potential effects, such as raising the barriers to entry into a market and eliminating potential competition, but they have rejected the more general claim of "the rising tide of economic concentration in American industry. In an oligopolistic industry, just a few major competitors so dominate the industry that competition is quelled. P&G was the leading seller of household cleansers, with annual sales of more than $1 billion. Since all liquid bleach is chemically identical, advertising and promotion plays the dominant role in selling the product. Prior to the merger, P&G did not make or sell liquid bleach; hence it was a product-extension merger rather than a horizontal one. Many subsequent cases have come out in favor of the defendants on a variety of grounds-that the merger led simply to a more efficient acquired firm, that the existing competitors were strong and able to compete, or even that the acquiring firm merely gives the acquired company a deep pocket to better finance its operations. In Procter & Gamble, for example, P&G might have entered the liquid bleach market itself and thus given Clorox a run for its money. This theory depends on proof of some probability that the acquiring company would have entered the market. Reciprocity is the practice of a seller who uses his volume of purchases from the buyer to induce the buyer to purchase from him.

When the surety turns to the principal debtor and demands reimbursement blood pressure medication what does it do cheap 1 mg terazosin with visa, the latter may have defenses against the surety-as noted-for acting in bad faith pulse pressure range normal buy 5mg terazosin fast delivery. Defenses of the Surety Generally pulse pressure gap buy 1mg terazosin with amex, the surety may exercise defenses on a contract that would have been available to the principal debtor (e nhanes prehypertension generic terazosin 2mg fast delivery. Common defenses raised by sureties include the following: Release of the principal pulse pressure 100 discount terazosin 5mg online. Whenever a creditor releases the principal blood pressure medication voltaren 2 mg terazosin with mastercard, the surety is discharged, unless the surety consents to remain liable or the creditor expressly reserves her rights against the surety. If the creditor alters the instrument sufficiently to discharge the principal, the surety is discharged as well. A creditor who fails to file a financing statement or record a mortgage risks losing the security for the loan and might also inadvertently release a surety, but the failure of the creditor to resort first to collateral is no defense. Suretyship contracts are among those required to be evidenced by some writing under the statute of frauds, and failure to do so may discharge the surety from liability. However, fraud by the principal debtor on the surety to induce the suretyship will not release the surety if the creditor extended credit in good faith; if the creditor knows of the fraud perpetrated by the debtor on the surety, the surety may avoid liability. A contract of suretyship is a type of insurance policy, where the surety (insurance company) promises the creditor that if the principal debtor fails to perform, the surety will undertake good-faith performance instead. A difference between insurance and suretyship, though, is that the surety is entitled to reimbursement by the principal debtor if the surety pays out. The surety is also entitled, where appropriate, to exoneration, subrogation, and contribution. The principal debtor and the surety both have some defenses available: some are personal to the debtor, some are joint defenses, and some are personal to the surety. How can it be said that sureties do not anticipate financial losses like insurance companies do Even though no pleadings were filed by Rike-Kumler Company, the issue from the briefs is whether or not a valid security interest was perfected in this chattel as consumer goods, superior to the statutory title and lien of the trustee in bankruptcy. Findings of Fact the [debtor] purchased from the Rike-Kumler Company, on July 7, 1964, the diamond ring in question, for $1237. The controversy is between the trustee in bankruptcy and the party claiming a perfected security interest in the property. The recipient of the property has terminated her relationship with the [debtor], and delivered the property to the trustee. Conclusion of Law, Decision, and Order If the diamond ring, purchased as an engagement ring by the bankrupt, cannot be categorized as consumer goods, and therefore exempted from the notice filing requirements of the Uniform Commercial Code as adopted in Ohio, a perfected security interest does not exist. Under the commercial code, collateral is divided into tangible, intangible, and documentary categories. Does the fact that the purchaser bought the goods as a special gift to another person signify that it was not for his own "personal, family or household purposes" The trustee urges that these special facts control under the express provisions of the commercial code. When the [debtor] purchased the ring, therefore, it could only have been "consumer goods" bought "primarily for personal use. By the foregoing summary analysis, it is apparent that the diamond ring, when the interest of the debtor attached, was consumer goods since it could have been no other class of goods. Is a promise, as valid contractual consideration, included under the term "value" In other words, was the ring given to his betrothed in consideration of marriage (promise for a promise) If so, and "value" has been given, the transferee is a "buyer" under traditional concepts. The purpose of uniformity of the code should not be defeated by the obsessions of the code drafters to be all inclusive for secured creditors. Even if the trustee, in behalf of the unsecured creditors, would feel inclined to insert love, romance and morals into commercial law, he is appearing in the wrong era, and possibly the wrong court. Ordered, that the Rike-Kumler Company holds a perfected security interest in the diamond engagement ring, and the security interest attached to the proceeds realized from the sale of the goods by the trustee in bankruptcy. What argument did the trustee make as to why he should be able to take the ring as an asset belonging to the estate of the debtor In August 2000, plaintiff purchased a 2000 Ford Explorer from auto dealer Webb Ford. Plaintiff, a native Spanish speaker, negotiated the purchase with a Spanish-speaking salesperson at Webb. Plaintiff signed what he thought was a contract for the purchase and financing of the vehicle, with monthly installment payments to be made to Ford. Some years later, plaintiff discovered the contract was actually a lease, not a purchase agreement. Ford brought a replevin action against plaintiff asserting plaintiff was in default on his obligations under the lease. Accordingly, the question here is whether breaking into a locked garage to effectuate a repossession is a breach of the peace in violation of section 2A-525(3). There are no Illinois cases analyzing the meaning of the term "breach of the peace" as used in the lessor repossession context in section 2A-525(3). The plaintiff argued the repossession breached the peace and he was entitled to the statutory remedy for violation of section 9-503, denial of a deficiency judgment to the secured party, Chrysler. After a thorough analysis of the term "breach of the peace," the court concluded the term "connotes conduct which incites or is likely to incite immediate public turbulence, or which leads to or is likely to lead to an immediate loss of public order and tranquility. The probability of violence at the time of or immediately prior to the repossession is sufficient. Looking to cases in other jurisdictions, the court determined that, "in general, a mere trespass, standing alone, does not automatically constitute a breach of the peace. So long as the entry was limited in purpose (repossession), and so long as no gates, barricades, doors, enclosures, buildings, or chains were breached or cut, no breach of the peace occurred by virtue of the entry onto his property. We agree with [this] analysis of the term "breach of the peace" in the context of repossession and hold, with regard to section 2A-525(3) of the Code, that breaking into a locked garage to effectuate a repossession may constitute a breach of the peace. Before making a finding of unconscionability under subsection (1) or (2), the court, on its own motion or that of a party, shall afford the parties a reasonable opportunity to present evidence as to the setting, purpose, and effect of the lease contract or clause thereof, or of the conduct. This allegation is insufficient to state a cause of action against Ford under section 2A-108. First, Ford is an entirely different entity than Webb Ford and plaintiff does not assert otherwise. Plaintiff asserts no basis on which Ford can be found liable for something Webb Ford did. Second, there is no allegation as to how the contract violates [the statute], merely the legal conclusion that it does, as well as the unsupported legal conclusion that a violation of [it] is necessarily unconscionable. Under what circumstances, if any, would breaking into a locked garage to repossess a car not be considered a breach of the peace If it was determined on remand that a breach of the peace had occurred, what happens to Ford Defenses of the Principal Debtor as against Reimbursement to Surety Fidelity and Deposit Co. The Spiveys and Douglas Asphalt had executed a General Indemnity Agreement in favor of Fidelity and Zurich. Douglas Asphalt and the Spiveys argue that the district court erred in entering judgment in favor of Fidelity and Zurich because Fidelity and Zurich acted in bad faith in three ways. First, Douglas Asphalt and the Spiveys argue that the district court erred in not finding that Fidelity and Zurich acted in bad faith because they claimed excessive costs to remedy the default. Specifically, Douglas Asphalt and the Spiveys argue that they introduced evidence that the interstate project was 98% complete, and that only approximately $3. Second, Douglas Asphalt and the Spiveys argue that Fidelity and Zurich acted in bad faith by failing to contest the default. However, the district court concluded that the indemnity agreement required Douglas Asphalt and the Spiveys to request a contest of the default, and to post collateral security to pay any judgment rendered in the course of contesting the default. Yet, Douglas Asphalt and the Spiveys did not direct the district court or this court to any case law that holds that the refusal to permit a defaulting contractor to continue working on a project is bad faith. Fidelity and Zurich exercised that contractual right, and, as the district court noted, the exercise of a contractual right is not evidence of bad faith. What did the plaintiffs claim the defendant sureties did wrong as relates to how much money they spent to cure the default Article 9 lumps together all the former types of security devices, including the pledge, chattel mortgage, and conditional sale. Five types of tangible property may serve as collateral: (1) consumer goods, (2) equipment, (3) farm products, (4) inventory, and (5) fixtures. Five types of intangibles may serve as collateral: (1) accounts, (2) general intangibles (e. Article 9 expressly permits the debtor to give a security interest in after-acquired collateral. To create an enforceable security interest, the lender and borrower must enter into an agreement establishing the interest, and the lender must follow steps to ensure that the security interest first attaches and then is perfected. Once the interest attaches, the lender has rights in the collateral superior to those of unsecured creditors. The financing statement, effective for five years, must be filed in a public office; the location of the office varies among the states. Goods may also be secured through pledging, which is often done through field warehousing. For the most part, self-help private repossession continues to be lawful but risky. After repossession, the lender may sell the collateral or accept it in satisfaction of the debt. If the surety is required to perform, it has rights for reimbursement against the principal, including interest and legal fees; and if there is more than one surety, each standing for part of the obligation, one who pays a disproportionate part may seek contribution from the others. Kathy Knittle borrowed $20,000 from Bank to buy inventory to sell in her knit shop and signed a security agreement listing as collateral the entire present and future inventory in the shop, including proceeds from the sale of inventory. If they were to default on their house payments, First Bank could repossess the house; could it repossess the car, too Kathy Knittle borrowed $20,000 from Bank to buy inventory to sell in her knit shop and signed a security agreement listing her collateral-present and future-as security for the loan. Debtor, having been called for repayment, asked for a ninety-day extension, which Creditor assented to , provided that Debtor would put up a surety to secure repayment. First Bank has a security interest in equipment owned by Kathy Knittle in her Knit Shop. Understand the terminology used in mortgage transactions, and how mortgages are used as security devices. A long time ago, the mortgage was considered an actual transfer of title, to become void if the debt was paid off. The modern view, held in most states, is that the mortgage is but a lien, giving the holder, in the event of default, the right to sell the property and repay the debt from the proceeds. The buyer needs to borrow to finance the purchase; in exchange for the money with which to pay the seller, the buyer "takes out a mortgage" with, say, a bank. The lender is the mortgagee, the person or institution holding the mortgage, with the right to foreclose on the property if the debt is not timely paid. The Uses of Mortgages Most frequently, we think of a mortgage as a device to fund a real estate purchase: for a homeowner to buy her house, or for a commercial entity to buy real estate (e. But the value in real estate can be mortgaged for almost any purpose (a home equity loan): a person can take out a mortgage on land to fund a vacation. Some debtors just walked away, leaving the banks with a large number of houses, commercial buildings, and even shopping centers on their hands. Short History of Mortgage Law the mortgage has ancient roots, but the form we know evolved from the English land law in the Middle Ages. In the fourteenth century, the mortgage was a deed that actually transferred title to the mortgagee. If desired, the mortgagee could move into the house, occupy the property, or rent it out. But because the mortgage obligated him to apply to the mortgage debt whatever rents he collected, he seldom ousted the mortgagor. Moreover, the mortgage set a specific date (the "law day") on which the debt was to be repaid. If the mortgagor did so, the mortgage became void and the mortgagor was entitled to recover the property. If the mortgagor failed to pay the debt, the property automatically vested in the mortgagee. The only possible relief was a petition to the king, who over time referred these and other kinds of petitions to the courts of equity. Thus a new right developed: the equitable right of redemption, known for short as the equity of redemption. In time, the courts held that this equity of redemption was a form of property right; it could be sold and inherited. This was a powerful right: no matter how many years later, the mortgagor could always recover his land by proffering a sum of money. Understandably, mortgagees did not warm to this interpretation of the law, because their property rights were rendered insecure. They tried to defeat the equity of redemption by having mortgagors waive and surrender it to the mortgagees, but the courts voided waiver clauses as a violation of public policy.

2mg terazosin with mastercard. Xiaomi iHealth BP3L Smart Wireless Blood Pressure monitor for Rs. 3500 (approx).

The plant juice is said to relieve headaches if taken nasally prehypertension que es buy discount terazosin 2mg on-line, but is considered caustic and toxic blood pressure medication prices cheap terazosin 2mg otc, and is probably dangerous taken internally (Chevallier 1996) 000 heart attack terazosin 2 mg sale. However useless eaters hypertension zip terazosin 1 mg, those with sensitive 132 skin may suffer irritation and sometimes blistering blood pressure scale uk terazosin 2 mg cheap, from crushing the vegetation with bare hands blood pressure yang normal generic terazosin 1mg visa. Of the headache cure, it has been said that "the patient immediately forgets the headache as a minor ailment compared with the sensation of exploding head, smarting nose and watering eyes, which fortunately lasts only momentarily". Sometimes there is no effect, suggesting variation in chemistry due to undetermined factors (Cribb & Cribb 1981). America; the fresh bark, leaves, and flowers are the parts used, in the form of a tincture or infusion. In this form they have been taken internally as diuretics and sudorifics, as well as to relieve insomnia, neuralgia, toothache, cystitis, gonorrhoea, and numerous other complaints. The Teton Sioux also used the root for their horses, administering it as a snuff when being chased by foes (Morgan 1981; Ott 1993). This stimulant action may be merely due to the irritant action of the protoanemonin in these plants, in low doses. Protoanemonin is a bitter -butyrolactone derivative, which causes blistering on contact [see also Ranunculus] (Budavari et al. On drying, protoanemonin is converted to anemonin [1,2-dihydroxy-1,2cyclobutanediacrylic acid di-lactone]. Both protoanemonin and anemonin have shown sedative activity, and anemonin also acts as an antipyretic (Martin et al. Leaves usually trifoliate; lateral and terminal leaflets similar, ovate, acuminate, rarely entire, commonly coarsely toothed with mucronate teeth, occasionally lobed, the uppermost smaller and sometimes simple; petiolules of roughly equal length. Flowers in panicles from many axils, roughly equalling the subtending leaves; sepals white or dull white, commonly 4, oval or oblong, 10-15mm long, pubescent on back, glabrous or pubescent on upper side; petals none; stamens numerous. Fruit a flattened achene, terminated by the style, numerous in a globose head, pubescent. Seeds should be sown soon after collection; may also be cultivated by layering, or from cuttings taken before the late spring flowering period (Burras ed. Clerodendrum floribundum is a small, sparse tree to 5m tall; bark light grey to brown, corky, fissured. Leaves opposite, broadly ovate-elliptic, widest near base, prominent central and lateral veins, 3-15 x 3-10cm; petioles 7cm long. Inflorescences many-flowered terminal or axillary cymes; calyx red, fleshy, 5-lobed, lobes 4-6mm long, persistent, spreading; corolla salverform, tube narrowly cylindric, straight or incurved, +equal in diameter throughout, limb 5-parted, spreading or subreflexed; stamens 4, exserted, didynamous, alternate with corolla lobes, involute in bud; anthers opening by longitudinal slits. In a range of habitats, including monsoon vine thickets, open forest and woodland; all regions of Northern Territory [Australia] (Aboriginal Communities 1988; Gleason 1952 [for some genus detail]). Generally, a decoction is made from 3-6 young leaves, which is then applied externally for sores or itchy skin, or taken internally to treat headache, backache, internal pains, diarrhoea, colds and bronchial congestion. The plant has shown analgesic, decongestant, antidiarrhoeal and antipruritic effects (Aboriginal Communities 1988; Lassak & McCarthy 1990; Low 1990). Uses include treatment of fevers, malaria, dropsy, venereal diseases, scabies and internal parasites (Lassak & McCarthy 1990; Low 1990). The roots of this species have been used as an analgesic, antiinflammatory and antipyretic, activites which have also been demonstrated in animal studies (Narayanana et al. They have been used to treat rheumatic arthritis, asthma and bronchitis (Zhu et al. The leaves contained 1% tannin, but no active principles were isolated (Aboriginal Communities 1988). Some Bantu-speaking peoples use it as a ritual drink, and it is often taken with Cannabis. Coffee berries are harvested when deep red, and are initially put in water to separate the over-ripe berries [which float]. Fermentation is said to improve the flavour of the resultant coffee; it also increases the caffeine content through metabolism of nucleic acids. In roasting, beans should be heated evenly; also, temperatures should be kept as low as possible, and roasting as brief as possible, so as not to burn or over-roast. Chocolatecoated coffee beans [see Theobroma] are also widely available and very popular with students in Melbourne, Australia (pers. It interferes with digestion, but can allay nausea in moderate amounts; it also can increase the effects of some analgesics, possibly due to the enzyme P450-inhibiting capacity of chlorogenic acid, caffeic acid, and some related polyphenols. Excessive doses [more than several cups in one sitting] can cause nervous agitation, insomnia, hypertension, nausea, sweating, confusion, and even indistinct colour hallucinations. A cup of coffee brewed from ground beans may contain 39-190mg of caffeine; a cup of instant coffee 29-99mg; and a cup of decaffeinated coffee 0-75mg (Gilbert et al. Brewed coffee of various kinds may contain up to 210g/l carbolines, mostly norharman with smaller amounts of harman; these appear to be formed during roasting (Alves et al. A stearoyl-homologue was also mentioned as being found, but not included in this ratio calculation. Sucrose and trigonelline are largely degraded during roasting, and nicotinic acid is formed. Leaves and fruits contain xanthine, hypoxanthine, guanine, adenine, vernine, and small amounts of caffeine [0. Coffea arabica is a glabrous evergreen shrub or small tree to 5m; branchlets compressed. Leaves evergreen, opposite (rarely in threes), 1020cm long, shining, with conspicuous lateral veins, oblong-elliptic, apex shortly acuminate; stipules broad, interpetiolar. Flowers clustered in leaf axils, or in condensed 1-2-nate axillary cymes, appearing with leaves, white, fragrant, tubular; bracteoles often connate; calyx-tube short, limb short, often glandular, persistent; corolla 85-130mm long, 5-lobed, lobes 10-15mm long, spreading, twisted in bud; anthers 4-7, sessile, often recurved or twisted. Ovary 2-celled; style slender, bifid at apex; ovules solitary in each cell, peltate on septum. Coffee trees can be grown from cuttings, but seed propagation is the usual method. Seeds germinate in 4-8 weeks [up to 3 months according to other sources]; they may be sown where they are to grow, in prepared ground, or they are grown in nurseries and transplanted when 6-24 months old. Unshaded trees give higher yields, and regular fertilisation and weeding are needed. The soil around a coffee tree gradually becomes rich in caffeine from fallen plant matter; thus the soil is rendered +- toxic, and coffee plantations degenerate after 10-25 years or more for this reason (Gilbert 1986; Morton 1977). Africa, was said to have been brought to earth long ago by the creator, who on one visit left behind a piece he had been chewing. This was noticed by a watching man who, despite the warnings of a woman, placed it in his mouth and began to enjoy it. In their natural range of tropical Africa the nuts [or rather, the embryo of the seeds] of C. They are known to relieve fatigue, depression and headaches, give stamina, improve digestion, stimulate the cariac and respiratory systems, and allay appetite and thirst. The nuts are often preferred over coffee [see Coffea] and tea [see Camellia] as a stimulant. Sometimes they are used as divinatory objects, as currency, as gifts for the gods, or as simple gifts to friends. In general, older nuts are held in higher esteem, as are white or pink nuts which are kept to give to special guests. It was often consumed in palm-wine [see Methods of Ingestion] drinking sessions (De Smet 1998). The introduction of cola trees to India has led to their use as a stimulant nervine tonic there, as well (Nadkarni 1976). When dried, a small portion of the caffeine becomes bound with catechin and tannins; when fresh seeds are lyophilised, most of the caffeine present becomes bound. Leaves alternate, entire, oblanceolate to narrowly oblong or elliptic, sometimes narrowly obovate, up to 22 x 8cm, apex gradually longacuminate, acumen often twisted downwards, base cuneate or rounded. Indumentum on inflorescence often comparitively sparse and free; inflorescence puberulous, up to 9cm long; flowers hermaphrodite or unisexual, actinomorphic, up to 2(-3)cm long, whitish, in dense clusters; sepals valvate, mostly partly connate or rarely spathaceous; petals 5, or absent, contorted-imbricate, often hooded; stamens free or connate into a column, sometimes with staminodes; anthers 2-celled, in 2 whorls. Ovary superior, of 2-12 united carpels or of 1 carpel; ovules on axile placentas; style simple or rarely free to the base. Fruiting carpels russet-brown or olivaceous, rough to touch due to minute indumentum, not nobbly, up to 20 x 6cm, narrowed to apex, upper suture not conspicuously ridged, apex not deflexed; seeds up to 14 per carpel, each seed with (2-)3-4(-6) cotyledons. Later field work failed to find confirmation for this use, and researchers were told the plants were only ornamental (Schultes & Hofmann 1980, 1992; Wasson 1962). It would not seem unlikely if Mazatec people who knew of the use of Coleus had since decided not to divulge any more information. It is to be remembered that in cases where the indigenous use of sacred plants has been reported [such as with Psilocybe and Lophophora, both prominent Mexican examples], an influx of drug-enthusiasts has often followed, creating unwelcome disruption of the small communities where such use is often based, as well as inviting police harassment. Peru the leaves are used externally as an antiinflamma- tory, but are believed to be too toxic to take internally (De Feo 2003). It is also used in Samoa as a remedy for elephantiasis (Ott 1993), and it treats dysentery and digestive problems in Ayurvedic medicine, along with C. The plant is antispasmodic, dilates bronchioles and blood vessels, increases circulation to the brain, lowers blood pressure, and acts as a heart tonic. The leaves and roots are harvested in autumn (Ammon & Muller 1985; Bone 1996; Chevallier 1996). In China, the plant is used to treat epilepsy and convulsions (Kirtikar & Basu 1980; Nadkarni 1976; Perry & Metzger 1980). Sap from the closely-related Solenostemon latifolius is used in the Congo as a cardiac sedative, and to ensure nightmare-free sleep. Also, the mode of administration may have been inappropriate in some instances, as the leaves do not seem to be noticeably active via the oral route. They may show activity with sublingual administration [keep 1 or more large, thoroughly chewed leaves under the tongue for 20-30min. My single experiment involved smoking a dried alcohol extract, which had been evaporated onto a small amount of the original leaf as a binder. The solution had been left for 3 days with occasional shaking; the amount of dried extract smoked was the size of a small pea. The chewed fleshy leaves had a mild stimulating and euphoric effect in one psychonaut, which he compared to the effects of borneol (theobromus pers. In the process of analysis for salvinorin A, the leaf extract was shown to be rich in components, but their identities were not pursued as none were similar to salvinorin A (Gruber 1997). It lowers intraocular pressure, inhibits platelet aggregation, and activates the enzyme adenylate cyclase, causing increased thyroid secretion, adrenal steroid synthesis, and adrenocorticotropin release from pituitary (Ammon & Muller 1985; Bone 1996; Valdes et al. Forskolin is reputed to be psychoactive, in a similar way to other diterpenoids found in Salvia and Scutellaria (friendly pers. Coleus blumei (generally) is an annual herb or shrubby perennial, 30cm to 3m or more; stems and branches square, slightly succulent, often coloured (usually pale translucent green), angles generally obtuse, joints often hairy. Grows best in strong, indirect light in warm, rich, loose, well-drained moist soil. Start seeds indoors in flats of fine soil covered with glass or plastic; sow thinly and cover with a thin soil layer. The combustion fumes of city life often contribute to excessive leaf-dropping (Pedley & Pedley 1974; pers. A decoction of the unripe seeds in wine or opium wine [see Papaver] was a means of execution [either official or illicit] with the ancient Greeks. Besides having been an ingredient in some witches flying ointments [see Methods of Ingestion], hemlock has been used magically to induce astral projection, and in spells to banish sexual desires. Its juice was also rubbed on ritual knives and swords to empower and purify them before use. A German folk tradition tells that hemlock was home to a toad [see Bufo], which lived under the plant and sucked its venomous properties from it. In the Middle Ages, the sedative action of hemlock was used to counter conditions such as epilepsy, mania, and `St. Animals including humans have suffered from hemlock poisoning, though animals are rarely stupid enough to eat it (Lamp & Collet 1989; McBarron 1983). A mixture of unidentified compounds [several amino acids and two alkaloids] was found in leaf, fruit, and root, at all stages of development. Seedlings and young leaves contain predominantly -coniceine, with coniine levels increasing as the leaves mature. Alkaloid levels peaked in the fruits after 4-5 weeks of development; the highest yield obtained was. Alkaloid yields, and relative proportions of coniine/-coniceine, were observed to fluctuate widely throughout the course of a day [samples taken 4-hourly], with highest overall levels at 4am, 4pm, and 12 midnight, and lowest at 8am and 12 midday, in weeks 4 and 5. Aborted fruits were shown to consistently bear higher alkaloid concentrations, compared to normal fruits.

Private equity involves financing from private investors blood pressure medication that starts with m best terazosin 2mg, whether individuals (angel investors) or a private equity firm pulse pressure pregnancy cheap terazosin 5mg with amex. Venture capital is often used as a fundraising mechanism by businesses that are just starting operations heart attack 6 hours order terazosin 1mg line. The articles of incorporation govern the total number of shares of stock that the corporation may issue prehypertension in spanish terazosin 5mg fast delivery, although it need not issue the maximum pulse pressure medscape 5mg terazosin with amex. Stock in the hands of shareholders is said to be authorized heart attack 3d generic terazosin 5 mg mastercard, issued, and outstanding. Preferred stock (1) may have a dividend preference, (2) takes preference upon liquidation, and (3) may be convertible. Common stock normally has the right to (1) ratable participation in earnings, (2) ratable participation in the distribution of net assets on liquidation, and (3) ratable vote. Ordinarily, the good-faith judgment of the directors concerning the fair value of the consideration received for stock is determinative. A minority of states adhere to a true value rule that holds to an objective standard. The Sarbanes-Oxley Act of 2002 adds another layer of regulation to the financial transactions discussed in this chapter. The law imposes certain limitations on the amount that the corporation may disburse; most states restrict the cash or property available for distribution to earned surplus. However, a few states, including Delaware, permit dividends to be paid out of the net of current earnings and those of the immediately preceding year, both years taken as a single period; these are known as nimble dividends. The directors have discretion, within broad limits, to set the level of dividends; however, they will be jointly and severally liable if they approve dividends higher than allowed by law or under the articles of incorporation. With several options available, corporations face many factors to consider in deciding how to raise funds. A corporation must carefully weigh the pros and cons of each before making a decision to proceed on a particular financing path. Ralph and Alice have decided to incorporate their sewer cleaning business under the name R & A, Inc. Their plans call for the authorization and issuance of 5,000 shares of par value stock. Ralph argues that par value must be set at the estimated market value of the stock, while Alice feels that par value is the equivalent of book value-that is, assets divided by the number of shares. They want to raise $5 million to get their business up and running, to purchase a building, and to acquire machines to clean sewers. Would your suggestion be different if Ralph and Alice wanted to raise $500 million The duties, powers, and liability of officers and directors Power within a corporation is present in many areas. We focus this chapter upon these powers and upon the duties owed by shareholders, directors, and officers. Two Types of Corporate Powers A corporation generally has three parties sharing power and control: directors, officers, and shareholders. Directors are the managers of the corporation, and officers control the day-to-day decisions and work more closely with the employees. The shareholders are the owners of the corporation, but they have little decision-making authority. The corporation itself has powers; while a corporation is not the same as a person (e. Express Powers the corporation may exercise all powers expressly given it by statute and by its articles of incorporation. The powers set out in this section need not be included in the articles of incorporation. Implied Powers Corporate powers beyond those explicitly established are implied powers. Could Ted, its vice president and general manager, authorize the expenditure of funds to pay for a Sunday afternoon lecture on the perils of nuclear war or the adventures of a professional football player The Ultra Vires Doctrine the law places limitations upon what acts a corporation may undertake. Corporations cannot do anything they wish, but rather, must act within the prescribed rules as laid out in statute, case law, their articles of incorporation, and their bylaws. Sometimes, though, a corporation will step outside its permitted power (literally "beyond the powers). The ultra vires doctrine holds that certain legal consequences attach to an attempt by a corporation to carry out acts that are outside its lawful powers. Ultra vires (literally "beyond the powers") is not limited to illegal acts, although it encompasses actions barred by statute as well as by the corporate charter. Under the traditional approach, either the corporation or the other party could assert ultra vires as a defense when refusing to abide by a wholly executory contract. For example, particularly in the area of environmental law, plaintiffs are challenging corporate environmental actions as ultra vires. Delaware corporation law states that the attorney general shall revoke the charter of a corporation for illegal acts. Additionally, the Court of Chancery of Delaware has jurisdiction to forfeit or revoke a corporate charter for abuse of corporate powers. Shareholders may bring suits against the corporation to enjoin it from acting beyond its powers. The corporation itself, through receivers, trustees, or shareholders, may sue incumbent or former officers or directors for causing the corporation to act ultra vires. The state attorney general may assert the doctrine in a proceeding to dissolve the corporation or to enjoin it from transacting unauthorized business (see Figure 45. However, every crime and tort is in some sense ultra vires because a corporation never has legal authority to commit crimes or torts. Criminal, Tortious, and Other Illegal Acts the early common law held that a corporation could not commit a crime because it did not have a mind and could not therefore have the requisite intent. An additional dilemma was that society could not literally imprison a corporation. The individuals within the corporation are much more likely to be held legally liable, but the corporation may be as well. For example, in extreme cases, a court could order the dissolution of the corporation; revoke some or all of its ability to operate, such as by revoking a license the corporation may hold; or prevent the corporation from engaging in a critical aspect of its business, such as acting as a trustee or engaging in securities transactions. That a corporation is found guilty of a violation of the law does not excuse company officials who authorized or carried out the illegal act. Legal punishments are being routinely added to the newer regulatory statutes, such as the Occupational Safety and Health Act, and the Toxic Substances Control Act-although prosecution depends mainly on whether and where a particular administration wishes to spend its enforcement dollars. Additionally, state prosecuting attorneys have become more active in filing criminal charges against management when employees are injured or die on the job. For instance, a trial court judge in Chicago sentenced a company president, plant manager, and foreman to twenty-five years in prison after they were convicted of murder following the death of a worker as a result of unsafe working conditions at a plant; [3] the punishments were later overturned, but the three pled guilty several years later and served shorter sentences of varying duration. The Securities and Exchange Commission, the Department of Justice, other regulatory bodies, and legal professionals have increasingly sought legal penalties against both corporations and its employees. See Exercise 2 at the end of this section to consider the legal ramifications of a corporation and its employees for the drunk-driving death of one of its patrons. The Supreme Court affirmed the conviction of a chief executive who had no personal knowledge of a violation by his company of regulations promulgated by the Food and Drug Administration. Employees directly responsible for violation of the law can also be held liable, of course. In short, violations of tort law, criminal law, and regulatory law can result in negative consequences for both the corporation and its employees. When a corporation is acting outside its permissible power, it is said to be acting ultra vires. A corporation engages in ultra vires acts whenever it engages in illegal activities, such as criminal acts. One student becomes highly intoxicated and dies as the result of an automobile collision caused by the student. Explain the various parts of the corporate management structure and how they relate to one another. Describe the processes and practices of typical corporate meetings, including annual meetings. Understand what corporate records can be reviewed by a shareholder and under what circumstances. General Management Functions In the modern publicly held corporation, ownership and control are separated. The shareholders "own" the company through their ownership of its stock, but power to manage is vested in the directors. In a large publicly traded corporation, most of the ownership of the corporation is diluted across its numerous shareholders, many of whom have no involvement with the corporation other than through their stock ownership. On the other hand, the issue of separation and control is generally irrelevant to the closely held corporation, since in many instances the shareholders are the same people who manage and work for the corporation. For example, they elect the directors, although only a small fraction of shareholders control the outcome of most elections because of the diffusion of ownership and modern proxy rules; proxy fights are extremely difficult for insurgents to win. And they must vote on certain extraordinary matters, such as whether to amend the articles of incorporation, merge, or liquidate. Meetings In most states, the corporation must hold at least one meeting of shareholders each year. Timely notice is required: not more than sixty days nor less than ten days before the meeting, under Section 7. Shareholders may take actions without a meeting if every shareholder entitled to vote consents in writing to the action to be taken. This option is obviously useful to the closely held corporation but not to the giant publicly held companies. Through its bylaws or by resolution of the board of directors, a corporation can set a "record date. Every share is entitled to one vote unless the articles of incorporation state otherwise. For instance, a company might decide to issue both voting and nonvoting shares (as we discussed in Chapter 45 "Corporate Powers and Management"), with the voting shares going to insiders who thereby control the corporation. Thus if there are 1 million shares, 500,001 must be represented at the shareholder meeting. The articles of incorporation may decree a different quorum but not less than one-third of the total shares entitled to vote. Cumulative Voting Cumulative voting means that a shareholder may distribute his total votes in any manner that he chooses-all for one candidate or several shares for different candidates. With cumulative voting, each shareholder has a total number of votes equal to the number of shares he owns multiplied by the number of directors to be elected. Thus if a shareholder has 1,000 shares and there are five directors to be elected, the shareholder has 5,000 votes, and he may vote those shares in a manner he desires (all for one director, or 2,500 each for two directors, etc. Several states have constitutional provisions requiring cumulative voting for corporate directors. Cumulative voting is meant to provide minority shareholders with representation on the board. Assume that Bob and Carol each owns 2,000 shares, which they have decided to vote as a block, and Ted owns 6,000 shares. With this method, by placing as many votes as possible for each director, Ted could cast 6,000 votes for each of his desired directors. Under cumulative voting, however, each shareholder has as many votes as there are directors to be elected. Hence with cumulative voting Bob and Carol could strategically distribute their 20,000 votes (4,000 votes multiplied by five directors) among the candidates to ensure representation on the board. By placing 10,000 votes each on two of their candidates, they would be guaranteed two positions on the board. Cumulative voting will not aid a given single director whose ouster is being sought because the majority obviously can win on a straight vote. Modern proxy voting allows shareholders to vote electronically through the Internet, such as at. Proxies are usually solicited by and given to management, either to vote for proposals or people named in the proxy or to vote however the proxy holder wishes. Through the proxy device, management of large companies can maintain control over the election of directors. Proxies must be signed by the shareholder and are valid for eleven months from the time they are received by the corporation unless the proxy explicitly states otherwise. Management may use reasonable corporate funds to solicit proxies if corporate policy issues are involved, but misrepresentations in the solicitation can lead a court to nullify the proxies and to deny reimbursement for the solicitation cost. Proxy statements must disclose all material facts, and companies must use a proxy form on which shareholders can indicate whether they approve or disapprove of the proposals. The company must either furnish the dissidents with a list of all shareholders and addresses or mail the proxies at corporate expense. Since management usually prefers to keep the shareholder list private, dissidents can frequently count on the corporation to foot the mailing bill. Voting Agreements Unless they intend to commit fraud on a minority of stockholders, shareholders may agree in advance to vote in specific ways. Such a voting agreement, often called a shareholder agreement, is generally legal. Shareholders may agree in advance, for example, to vote for specific directors; they can even agree to vote for the dissolution of the corporation in the event that a predetermined contingency occurs. A voting agreement is easier to enter into than a voting trust (discussed next) and can be less expensive, since a trustee is not paid to administer a voting agreement. A voting agreement also permits shareholders to retain their shares rather than turning the shares over to a trust, as would be required in a voting trust.

References